A Study of NPA and its Impact on Banking Performance

##plugins.themes.academic_pro.article.main##

Abstract

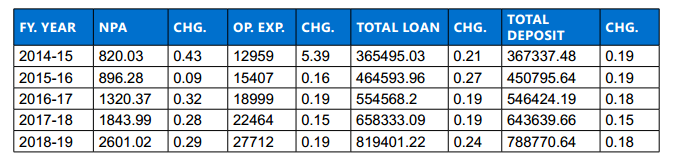

India's banks play a critical role in the country's economy. Many Indian banks confront numerous risks, including a large pile of non-performing assets, operational inefficiencies, and a lack of credit approval experience. Modern banks are increasingly focusing on a business stream distinct from traditional banking, which enables them to reduce their risk portfolio and maximize the efficiency of their labor and resources. When an asset does not create any income for the bank, it is referred to as a non-performing asset (NPA). The loans granted to customers are the bank's assets. The loan becomes a Bad Loan or Non-Performing Asset if the consumer does not pay either the interest or the principal. The purpose of this study is to identify what impact does NPA have on profitability and performance? The study found that NPA has a significant negative impact on total loan and operating expenses.

##plugins.themes.academic_pro.article.details##

References

- Agarwala, V., & Agarwala, N. (2019). A critical review of non-performing assets in the Indian banking industry. Rajagiri Management Journal, 13(2), 12–23. https://doi.org/10.1108/RAMJ-08-2019-0010

- Bikker De, J. A. (2010). Measuring performance of banks: An assessment, Netherlands Bank and Utrecht University. Journal of Applied Business and Economics, 11(4), 141–159.

- Das, S. K., & Uppal, K. (2021). NPAs and profitability in Indian banks: An empirical analysis. Future Business Journal, 7(1), article no.: 53. https://doi.org/10.1186/s43093-021-00096-3

- Dudhe, C. (2018). Impact of non-performing assets on the profitability of banks—Aselective study, 1(1) (pp. 307–314).

- Goyal, S. et al. (2016). Analysis of financial ratios for measuring performance of Indian public sector banks. International Journal of Engineering and Management Research Page, 6(2, March–April), 152–162.

- Limbore, N. V. (2014). A study of banking sector in India and overview of performance of Indian banks with reference to net interest margin and market capitalization of banks, Review of research, 679, 1–11.

- Nataraja N et.al.(2018).Financial Performance of Private Commercial Banks in India: Multiple Regression Analysis by Research Article: 2018 Vol: 22 Issue: 2, Academy of Accounting and Financial Studies Journal (Print ISSN: 1096-3685; Online ISSN: 1528-2635)

- Raj, M. et al. (2018). Non-performing assets: A comparative study of SBI&ICICI bank from 2014–2017. IOSR Journal of Business and Management (IOSR-JBM), VII(20 (9)), 78–84.

- Sensarma, R., & Ghosh, S. (2004). Net interest margin: Does ownership matter? Vikalpa: The Journal for Decision Makers, 29(1), 41–48. https://doi.org/10.1177/0256090920040104

- Siraj, K. K. (2013). The moderating role of bank performance indicators on credit risk of Indian public sector banks. International Journal of Finance and Accounting, 4(17), 219–226.

- Staikouras, C. K., & Wood, G. E. (2004). The determinants of European bank profitability. International Business and Economics Research Journal, 3(6), 57–68. https://doi.org/10.19030/iber.v3i6.3699