Hedging Opportunities between Weather and Other Financial Instruments using Pair-wise Trading Technique for Non-exchange Markets

##plugins.themes.academic_pro.article.main##

Abstract

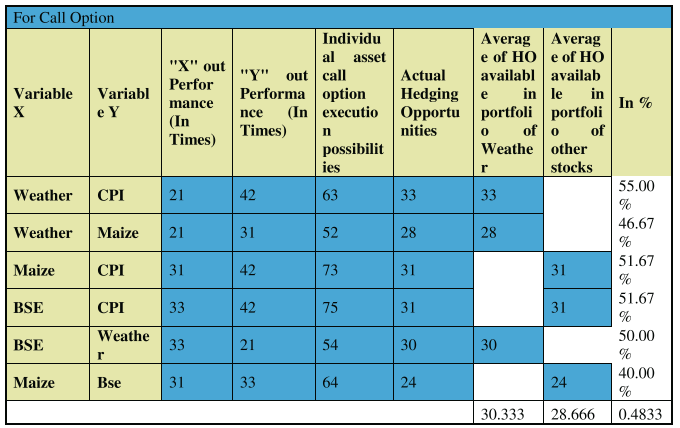

This article provides an analysis on the hedging opportunities between weather and other financial instruments with pair wise trading technique.Methods of analysis include growth rate calculations, its mean (return) and standard deviation (Risk). Other calculation includes finding hedging opportunities between all stocks individually and portfolio wise as well. All calculations can be found on attached excel.Result of data analyzed shows that any portfolio containing Weather is outperforming than the other financial instruments. In particular comparison of Weather to CPI shows the maximum hedging opportunities in Weather and in pair wise trading Weather – Maize and Bse- Weather are the best pair which showed 51 hedging opportunities revealing to 85.00%.The article finds the prospects of the Weather as effective tool to hedge the risk if traded actively in the stock market. Recommendation as discussed includes that agricultural insurance companies can use it as an effective measure to hedge the risk of investors.

##plugins.themes.academic_pro.article.details##

References

- Considine, G. (n.d.).Introduction to weather derivatives, http://www.globexcme.com/trading/weather/files/WEA_intro_to_weather_der.pdf, pp. 1-5. Accessed on 20.7.2011.

- Heimfarth, L.E., Finger,R. & Musshoff, O. (2012). Hedging weather risk on aggregated and individual farm-level: Pitfalls of aggregation biases on the evaluation of weather index-based insurance. Agricultural Finance Review, 72(3),471-487.

- Heimfarth, L.E. & Musshoff, O. (2011). Weather index-based insurances for farmers in the North China Plain-An analysis of risk reduction potential and basis risk. Agricultural Finance Review,71,2-17.

- Iffi, J. (2001). Government vs. weather: True story of crop insurance in India. Research Internship Papers 2001, Center for Civil Society, http://ccsindia.org/ccsindia/policy/live/studies/wpOO 10.pdf. Accessed on 23.7.2011.

- Liu, J., Men, C., Cabrera, V. E., Uryasev, S & Fraisse, C. W. (n.d.).Conditional value-at-risk model for optimizing crop insurance under climate variability, http://www.ise.ufl.edu/uryasev/crop_insurance_wp.pdf. Accessed on 20.5.2011.

- Malhotra, R (2012).Global warming and rising temperature: Ahedging opportunity. FIIB Business Review1 (2).

- Muller, A. & Grandi, M. (2000). Weather derivatives: A risk management tool for weather-sensitive industries. The Geneva Papers on Risk and Insurance,25(2), 273-287.

- Pres, J. (2009). Measuring non-catastrophic weather risks for businesses. The Geneva Papers on Risk & Insurance, 34(3), 425-439. http://dx.doi.org/10.1057/gpp.2009.16.Accessedon 14.10.2011.

- Taylor, J.W. &Buizza, R. (2006). Density forecasting for weather derivative pricing. International Journal of Forecasting.22. http://users.ox.ac.uk/~mast0315/WeatherDerivative.pdf. Accessed on 20.8.2011.

- Woodard, J.D. and Garcia, P. (2008). Basis risk and weather hedging effectiveness. Agricultural Finance Review,68(1),99-117.

- Woodard, J. D., & Garcia, P. (2008). Weather derivatives, spatial aggregation, and systemic risk: Implications for reinsurance hedging. Journal o f Agricultural and Resource Economics,33(1), 34-51. https://search.proquest.com/docview/214689500?accountid=l 84781. Accessed on 20.8.2011.